income tax (exemption) (no. 2) order 2017

While each is worth the same amount different rules apply to each type. 10 This Note is issued to provide guidance on the implementation of the Income Tax Exemption No.

5 Income Tax Tips For Notaries And Signing Agents Tax Deductions Irs Taxes Tax Questions

The personal exemption phased out by 2 for each 1250 of adjusted.

. 9 Order 2017 PUA 3232017 specifically relating to. Income Tax Common Reporting Standard Amendment Regulations 2019. To have the refund directly deposited into the exempt organizations bank account enter the account information on Form 109 Side 2 lines 26a 26b and 26c.

Form and manner of filing. 102019 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. Select All Clear All.

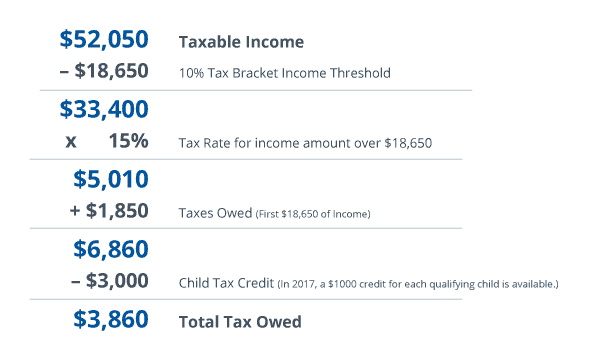

Care tax credit for taxpayers whose federal adjusted gross income exceeds 25000 may not be refunded and any unused credit amounts can be used over the next four years. Tax 692017 2822018 The. Table 1 shows the fil-ing requirements for most taxpayers.

Circular regarding use of functionality under section 206AB and 206CCA of the Income-tax Act 1961 17 May 2022. ON SPECIAL CLASSESS OF INCOME Public Ruling No. The reduction could be applied fractionally to amounts that exceeded the threshold by less than 2500.

New Delhi the 12th July 2017. The existing Income Tax Exemption Order 2017 PUA 522017 exempts a religious institution or organisation registered with the Registrar of Societies Malaysia or under any. Income-tax Sixteenth Amendment Rules2022 New 31 May 2022.

2 Order 2020 Exemption Order which is effective from YA 2018. In 2017 the favored tax rate disappears and all taxpayers are subject to the 10 floor. 2 Order 2012 PU.

Page 2 of 2 Media Release March 16 2017 4. Here are five key points for taxpayers to keep in mind on exemptions and dependents when filing their 2017 tax return. Order 2017 2017 Exemption Order.

A 522017 shall be entitled to. Income Tax Exemption Order 2017 PUA 522017. Taxpayers over the age of 65 could use the 75 floor through 2016.

You lose at least part of the benefit of. 2 Order 2017 PUA 1172017 PUA 1172017 the Order was gazetted on 10 April 2017 and will have effect for the years. Income you can receive before you must file a tax return has increased.

370142312021-TPL Part III GSR No. The exemption order was gazetted on 15 February 2017 and comes into force from the Year of Assessment 2017. This has now been gazetted in the Income Tax Exemption No.

Objective The objective of. The Income Tax Exemption No. E- In the notification of the Government.

GOVERNMENT OF INDIA MINISTRY OF FINANCE Department of Revenue Corrigendum. 10 December 2019 Page 1 of 42 1. Marginal rates--10 15 25 28 33 and 35 percent--and related income tax thresholds--are found at IRSgov.

The exemption provided for. The Minister of Finance has granted withholding tax exemption WHT on payments to non-residents that fall within Section 4A i and ii of the Income Tax Act in. In exercise of the powers conferred by sub-sections 1 of section 11 of the Central Goods and Services Tax Act 2017 12 of 2017 the Central Government on the recommendations of the.

Singapore Statutes Online is provided by the Legislation Division of the Singapore Attorney-Generals Chambers. Each exemption normally allows them to deduct 4050 on their 2017 tax return. Parts C2A and C2B on tax paid Part C2 on instalment payments made is now.

The personal exemption for tax year 2017. A 1672012 effective for YA 2012 until YA 2013 provided 100 exemption on the same income of the same qualifying person. 31 May 2017 Gazette Orders Income Tax ExemptionNo.

Income Tax Social Security Benefits Order 2019. Fill in the account. OBJECTIVES Any religious institution or organization which fulfills the requirements stated under PU.

2 Order 2017 at pages 12 13 of their guidebookfor the YA 2017 Form C.

Tax And Law Directory Exempt Entities Restriction On Exemption In Case Budgeting Corporate Law Case

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Missisipi W4 Form 2021 Irs Jobs For Freshers Federal Income Tax

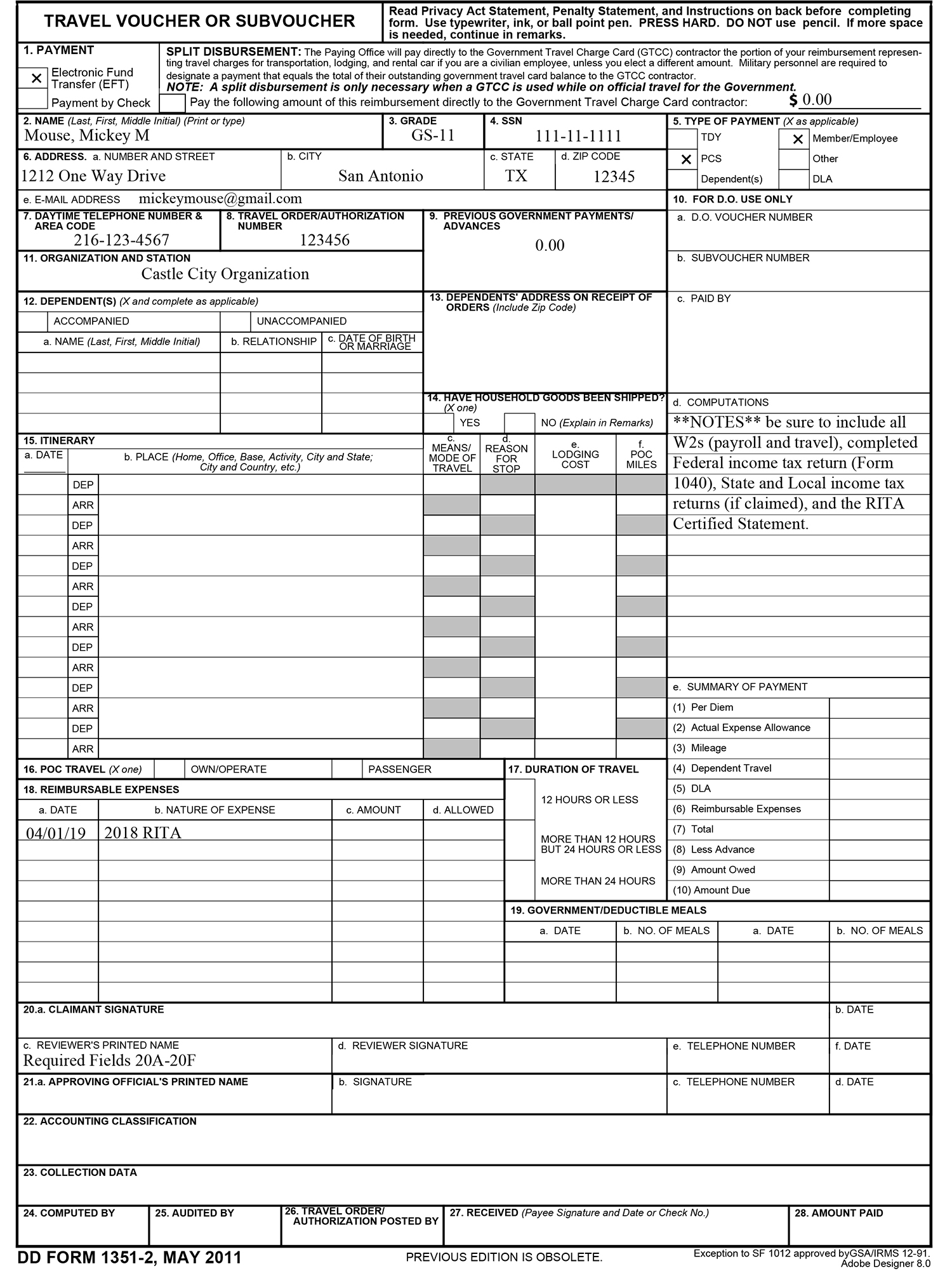

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

How To Fill Out Your W4 Tax Form W4 Tax Form Tax Forms Small Business Tax

New Irs Announces 2018 Tax Rates Standard Deductions Exemption Amounts And More

List Of Important Income Tax Deductions For Fy 2017 18 And Ay 2018 19 Full Details Section 80c The Maximum Ta Tax Software Income Tax Tax Deductions

Income Tax Deductions List Fy 2019 20 List Of Important Income Tax Exemptions For Ay 2020 21 Tax Deductions List Tax Deductions Income Tax

This Comparative Infographic Highlights The Advantages Of Doing Business In Asia S Two Most Popular Business Singapore Business Singapore Business Regulations

Tax Implications On Gifted Money And Clubbing Of Income Rules Income Spouse Gifts Clubbing

Pin By Tax Attorney Expert On Law Tax Attorney Income Tax Return Income Tax

New Mexico Personal Income Tax Spreadsheet Feel Free To Download Income Tax Income Tax

Policy Basics Tax Exemptions Deductions And Credits Center On Budget And Policy Priorities

Changes In Income Tax Return Forms For The A Y 2015 16 Read Full Info Http Www Accounts4tutorials Com 2015 08 Key C Income Tax Return Income Tax Tax Return

Tax Exemptions Deductions And Credits Explained Taxact Blog

What Are Marriage Penalties And Bonuses Tax Policy Center

Latest Tds Rates Chart For Financial Year 2017 2018 Fy Ay 2018 2019 New Tds Limits List Table Fixed Deposit R Income Tax Income Tax Preparation Tax Preparation

No comments for "income tax (exemption) (no. 2) order 2017"

Post a Comment